Jana Nidhi

|

With the objective of rebuilding the nation through youth empowerment, NYCS considers cooperatives as a model of business enterprise and is making every effort to promote entrepreneurship through the same. Financial activity is the main stay of any business. In this direction, NYCS India has set up centres across the country under the name of Jana Nidhi to provide need based finances to the youth for taking up income generating activities and opportunities through self-employment and entrepreneurship. The major activity of Jana Nidhi is to mobilize deposits from public and lending them short term loans and advances. Jana Nidhi has successfully raised deposits from general public in form of short and long term deposits and has distributed loans to more than 10000 youths. This has helped them to come out of the clutches of money lenders who charge heavy interest otherwise.

There are over 23 centres and 3 sub centres of Jana Nidhi across Kerala, Maharashtra, Delhi, Himachal Pradesh, Tamil Nadu, Gujrat, Madhya Pradhesh, Chandigarh, and few more coming up in Jharkhand and Orissa too. The operations are computerized to maintain uniformity and accountability across all the branches. Financial empowerment, sound financial returns, instant cash in need and small savings for big growth are the objectives of Jana Nidhi.

Why Microfinance?

Financial inclusion is generally defined as the availability of banking services at an affordable cost to disadvantaged and low-income groups. In India the basic tool of financial inclusion is having a saving or current account with a bank. But how many underprivileged people actually hold a bank account? How many are encouraged to do so? Even if they do hold an account, do they have an access to credit and advisory fascilities? To achieve inclusive growth in the country, expanding the scope of financial inclusion initiatives like immediate credit facilities, insurance facilities, financial advisory services etc. to reach out to people at the grass-root level is instrumental. Access to affordable credit, cultivating the habit to save money and face to face financial advices are the most beneficial aspects of financial inclusion. Microfinance is a gateway to achieve this financial inclusion that we are talking about

Lack of collateral or guarantors, inability to communicate the need and the high transaction costs in the banks make it difficult for the potential but financially restricted entrepreneurs to forge ahead with their ideas. On other hand, heavy rate of interests and unjust conditions by moneylenders make it difficult to raise the capital. Microfinance serves as a tool for providing financial services to the low-income population., which do not have access to the mainstream financial services.

Microfinance recognizes that poor people can be remarkable reservoirs of energy and knowledge. Often the Beneficiaries are from a low-income groups and require Loans are of a small amount. These loans are for short duration and offered without collateral. Loans are generally taken for income generation purposes, NYCS believes in empowering every capable person to contribute to the national economy after his own economic needs are satisfied. JanaNidhi is a dedicated division of NYCS that will encourage entrepreneurs to create or expand their business by providing them microfinance.

|

OUR BRANCHES

|

| Head Office, Pune |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., 1143A, Khodiyar Apartment, Flat no A2 & A3, Ground Floor, Shankar Maharaj Path, Opp. Police Ground, FC Road, Shivaji Nagar, Pune, Maharashtra - 411016 |

| Aluva, Kerala | Balussery, Kerala | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Kuzhikkattil Building, 1st Floor, Opposite St.May's High School Ground, Sub Jail Road, Aluva, Dist. Ernakulam, Kerala - 683101 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Century Complex, Opp Chirakkal Kavu, Main Road Balussery, Dist. Kozhikode, Kerala - 673612 | |

| Baramati, Maharashtra | Bardoli, Gujarat | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Shrusti complex, 4th Floor, Ring Road, near Satish Grihnirman Society, Baramati, Dist. Pune, Maharashtra - 413102 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., A/21, Patidar Jin Complex, Opp Sardar Arcode station Road, Bardoli, Dist. Surat, Gujarat - 394601 | |

| Bhandara, Maharashtra | Challkudy, Kerala | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Rajiv Gandhi Chowk, Rajgopalachari Ward, Bhandara PH. NO. 07184/255115, Dist. Bhandara, Maharashtra - 441904 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., 2nd Floor, Supriya building, South Jn, Chalakudy, Dist. Thitssur, Kerala - 680307 | |

| Chandigarh, Punjab | Chelakkara, Kerala | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Cabin No-4, 3rd Floor, Sector No-17-B, Sco.No. 111-113, Chandigarh (UT), 160017 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., 2nd Floor, SARAS Shoping complex, Chelakkara, Dist. Thitssur, Kerala - 680586 | |

| Kannady, Kerala | Kodunglur, Kerala | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Reg.mscs/CR/97/99, Eternal Tower, Kazhchaparamu, Kannadi, Palakkad, Kerala - 678701 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Anandhalaxmi Vilas, Near Old Municipal Building, South Nada, Kodungallur, Dist. Thrissur, Kerala - 680664 | |

| Kottayi, Kerala | Kozikode, Kerala | |

|

NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., 2/358, Puthumana Complex, 1st Floor, Perumkulangara, Kottayi - PO, Dist. Palakkad, Kerala - 678572

|

NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Noor Building, 1st Floor, Kallai Road, Kozhikkode, Dist. Kozhikode, Kerala - 673612 | |

| Kunamkulam, Kerala | Madurai, Tamilnadu | |

|

NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Mukkandath Building, Wadakkanchery Road, Kunnamkulam, Dist. Thrissur, Kerala - 680503

|

NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., 2 & 2A Grandson Building, 2nd Floor, West Perumal, Maistry Street Near Railway Station, Dist. Madhurai, Tamilnadu - 625001 | |

| Mehsana, Gujarat | Nagpur, Maharashtra | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Jananidhi Branch, Shanti Sadan, Owners Association, Opp. Harinagar Society, Near Appolo Complex, Highway Mahesana, Gujarat - 384002 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Jagnade Chowk, K. D. K. Collage Road, Rajandra nagar, Dahake bhawan, Dist. Nagpur, Maharashtra - 440009 | |

| New Delhi, Delhi | Pallakad, Kerala | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., CO Kovida Skill Development Center, WZ-49 Budella ,near DG 2 MIG flat, VIKASPURI, New Delhi - 18011 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Sree Valsam Centre, Ayyapuram, Kalpathy, P.O.Palakkad, Kerala - 678003 | |

| Patan, Gujarat | Puducherry, Puducherry | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., F8, Khadiya Shoping Center, Opposite Govt. Post Office, Railway Station Road, Dist. Patan, Gujrat - 384265 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., No. 1, 1 st Floor, Oulgaret Main Road, Mettupalayam, Puducherry - 605 009 | |

| Pune, Maharashtra | Purliya, West Bengal | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Surve no.11/1A, Rukmini Palace, Gundbandhu Colony, Rutuja Park, Near Commins Eng .College, KarveNagar, Dist. Pune, Maharashtra - 41105 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., At post. Raghabpur more, Deshbandhu Raod, Purulia, West Bengal - 723101 | |

| Surat, Gujarat | Tripunithura, Kerala | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Shop No. G6, Shaswat Residency, South zone Road, Udhana Gram, Dist. Surat, Gujarat - 394210 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Sreelakshmi Shopping Complex, Statue JN.Tripunithura, Ernakulam, Kerala - 682301 | |

| Trissur, Kerala | Trivendram, Kerala | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Alma Shopping Complex, Patturaikkal, Opp Deramata Church, Dist. Thrissur, Kerala - 680022 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD.,"Dildeeps" TC 24/368(1), Sasthancoil Road, Near Kerala Cricket Association, Thycaud, Thiruvananthapuram, Kerala - 695014 | |

| Urulikanchan, Maharashtra | Vadodara, Gujarat | |

| NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., Jananidhi Branch, Pune-Solapur Highway, Near Shivratna sales Corporation, Uralikanchan Ta.Haweli, Dist-Pune, Maharashtra - 412202 | NATIONAL YUVA CO-OPERATIVE SOCIETY LTD., N3, Dhawalgiri Appartment, Behind Kuber Bhavan, Kothi, Vadodara, Gujarat - 390001 |

_202312261258058734_H@@IGHT_560_W@@IDTH_800.jpg)

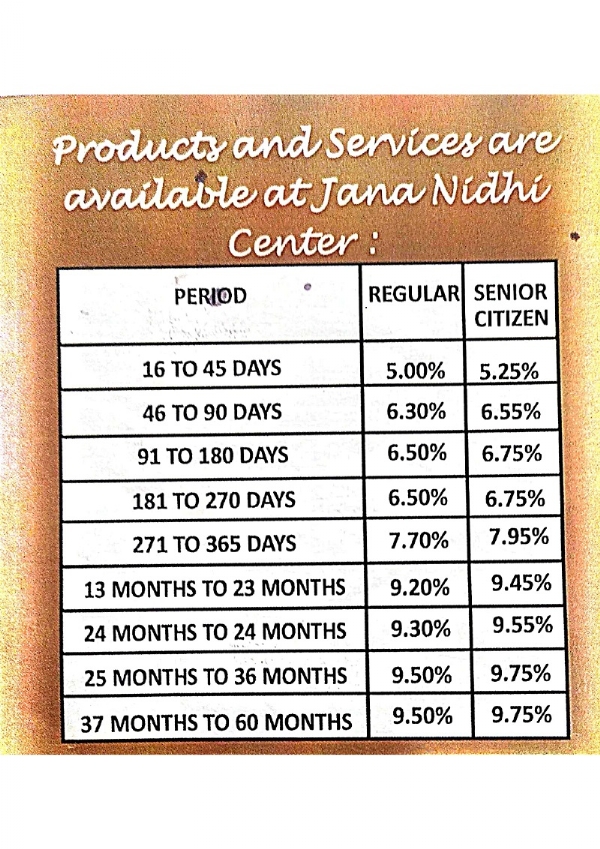

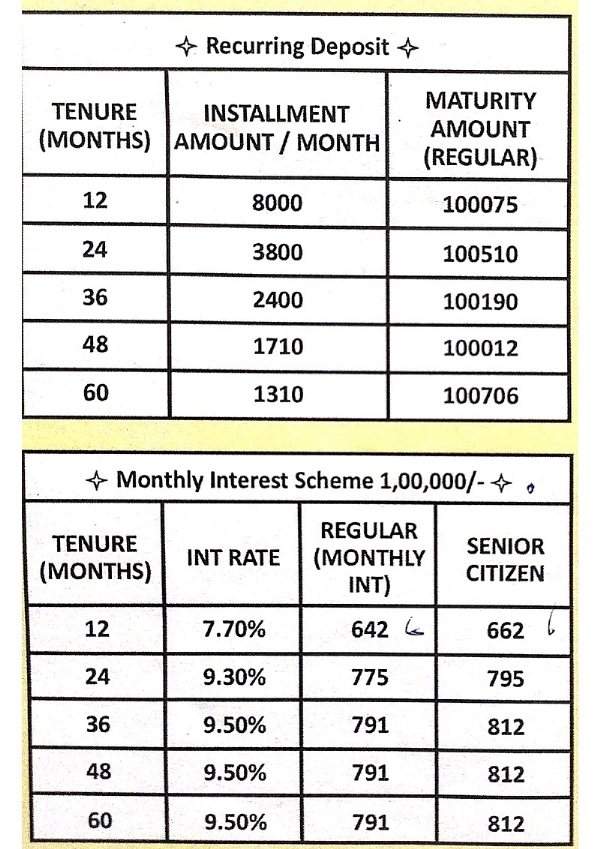

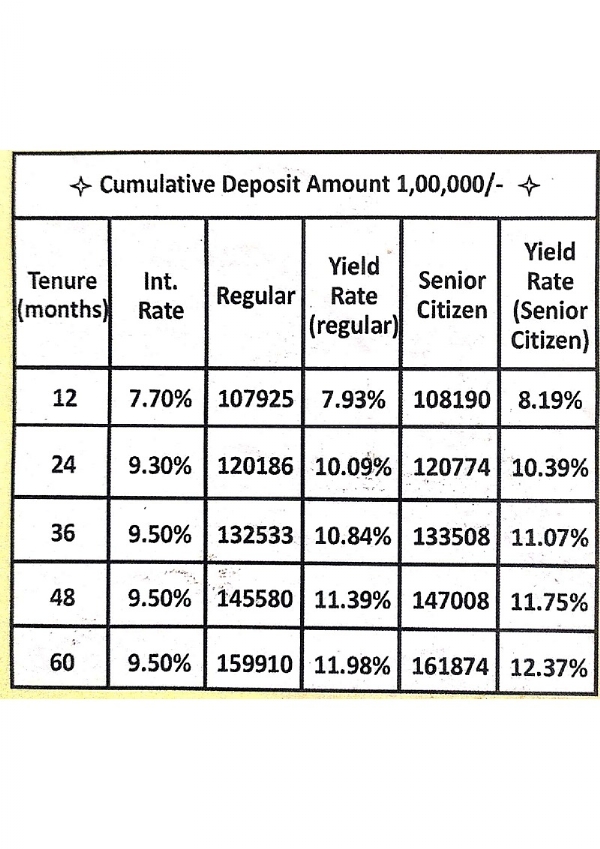

Interest rates on deposit schemes are subject to change due to market conditions and may take time to reflect it on web site. You are kindly requested to contact nearest Jana Nidhi branch for current ‘Rate of Interest’

Interest rates on loan schemes are subject to change due to market conditions and may take time to reflect it on web site. You are kindly requested to contact nearest Jana Nidhi branch for current ‘Rate of Interest’